This information is provided by Secfi for educational and illustrative purposes only and is not considered an offer, solicitation of an offer, advice, or recommendation to buy, sell, or hold any security. Investment products are not FDIC-insured, not guaranteed by any bank, and may lose value. Secfi Inc is not a bank and certain banking services are provided by Blue Ridge Bank, N.A., Member FDIC. Terms and conditions apply as detailed in each Personal Securities Contract. As used herein, "non-recourse" means that a Shareholder is not personally liable for the difference between the value of the advance made to Shareholder and the value of their applicable equity upon an issuer liquidity event, or absence of such event. Personal Securities Contracts are brokered by Secfi Securities, LLC, member FINRA / SIPC and you are encouraged to read our Customer Relationship Summary. Additional information can be found in the Secfi Securities Regulation Best Interest FAQs here. The Advisers do not provide any type of investment, securities, tax, or brokerage advice or services to the Shareholders in any capacity. Accordingly, the Funds are the Advisers’ clients Shareholders are not customers or clients of the Advisers. The Advisers do not have discretion to make investments on behalf of a Fund save for recommending Personal Securities Contracts consistent with the general strategy and investment guidelines of a particular Fund. Such advisory services performed by each Adviser are limited exclusively to recommending, arranging and negotiating Personal Securities Contracts on behalf of each Fund. The Advisers provide investment management services to the Funds on a non-discretionary basis solely with respect to the recommendation of certain Personal Securities Contracts in order to facilitate each Fund’s desired exposure to the relevant Companies. Each Fund has been or will be formed by the Fund Manager for various purposes, including but not limited to, acquiring exposure to the stock ("Shares") of late-stage and growth-stage private technology companies ("Companies") held by the employees of such companies who are seeking liquidity ("Shareholders"). Specifically, each Adviser serves as a non-discretionary sub-adviser to certain pooled investment vehicles (each, a "Fund") managed by a third-party manager (the "Fund Manager"). Secfi Advisory Limited and Secfi Limited are regulated by the Securities and Exchange Commission as exempt reporting advisers, providing non-discretionary investment advice to private funds. is a technology company offering a range of financial products and services through its wholly-owned, separate but affiliated subsidiaries, Secfi Advisory Limited and Secfi Limited (each, an “Adviser” and collectively, the “Advisers”) and Secfi Securities, LLC (an SEC-registered broker-dealer). The Probability Calculator gives the likelihood that prices are ever exceeded during the trading period, not just at the end.© Secfi 2022 - All rights reserved. If the stock, stock options, or combination becomes profitable before the end of the trading period (for example, before the expiration of some stock options), it is reasonable that a trader may decide to reap part or all of those profits at that time. In real trading, however, investors are following the price of a stock or stock options throughout the entire trading period. Many calculators are available that give the theoretical probability that a stock may approach certain values at the end of a trading period.

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

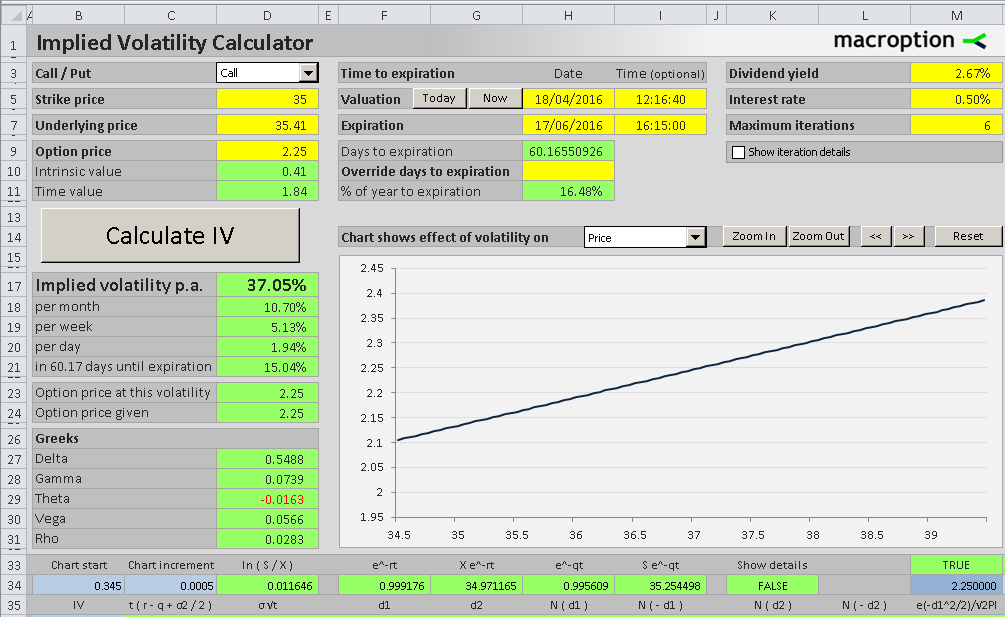

Over a number of trading days, the price of a stock may vary widely and still end up at or near the original purchase price. What makes McMillan’s Probability Calculator different? The program uses a technique known as Monte Carlo Simulation to produce estimates that assess the probability of making money in a trade, but can also be used by traders to determine whether to purchase or sell stock, stock options, or combinations thereof. McMillan’s Probability Calculator is low-priced, easy-to-use software designed to estimate the probabilities that a stock will ever move beyond two set prices-the upside price and the downside price-during a given amount of time. The Probability Calculator Software Simulate the probability of making money in your stock or option position.

0 kommentar(er)

0 kommentar(er)